student loan debt relief tax credit application 2021

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least 20000 in undergradgrad loan debt and still have 5000 outstanding.

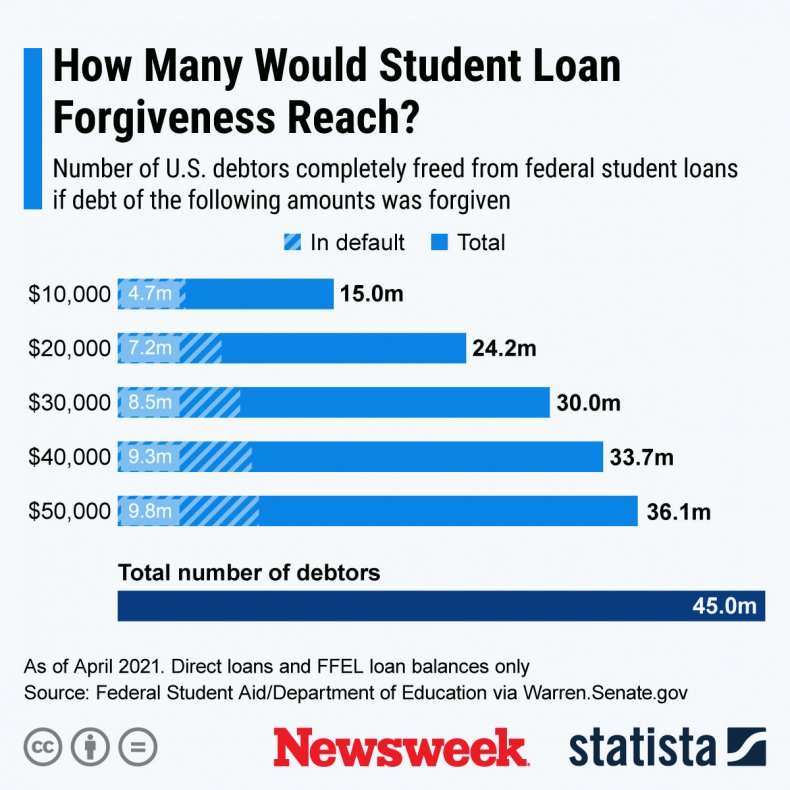

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

It was established in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators.

. It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt. But every case is different. CuraDebt is a company that provides debt relief from Hollywood Florida.

Have at least 5000 in outstanding student loan debt upon applying for the tax credit. The application will close September 15 2021. How does MHEC decide who receives the Tax Credit.

Who may apply. Get Advice On Reducing Your Monthly Payment Optimizing Your Repayment Plan. The first day you can apply for the 2020 tax-year credit is July 1 2021.

About the Company Student Loan Debt Relief Tax Credit Application. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

Ad Drowning in Student Debt. CuraDebt is an organization that deals with debt relief in Hollywood Florida. It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and accredited through the International Association of Professional Debt Arbitrators.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. CuraDebt is a company that provides debt relief from Hollywood Florida.

Recipients of the Student Loan Debt Relief Tax Credit have two options for debt repayment. Others eligible for relief. Make monthly payments to the lender until the amount of the tax credit is paid.

Head of Federal Student Aid pushes for an extension to the temporary. Compare Best Lenders Get Low Rates From 174 APR. Have the debt be in their the Taxpayers name.

Student Loan Tax Credit Application. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will. Tax - General Code Ann.

Have incurred at least 20000 in undergraduate andor graduate student loan debt. This tax credit could be of great benefit to Maryland taxpayers with student loans. From July 1 2022 through September 15 2022.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. From July 1 2022 through September 15 2022. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application.

The application is free. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. From July 1 2021 through September 15 2021.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. 2 days ago1 current trend within student loans for the week of July 5 2022. Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us.

Any credit youre awarded through this program must be used to pay your student loan. 1 i By September 15 of each year an individual shall submit an application to the Commission for the credit allowed under this. For those who qualify for a total.

Enter the Maryland Adjusted Gross Income reported on your Maryland State Income Tax return form 502 line 16 for the most recent prior tax year. About the Company Student Loan Debt Relief Tax Credit Application 2021 CuraDebt is a debt relief company from Hollywood Florida. If you already have.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. Open from Jun 30 2022 at 1159 pm EDT to Sep 15 2022 at 1159 pm EDT. Over 8 billion in debt relief has been approved since a temporary student loan forgiveness waiver was approved.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and.

Make a one-time payment for the amount of tax credit to lender. About the Company Student Loan Debt Relief Tax Credit Application 2021 Pdf CuraDebt is a debt relief company from Hollywood Florida. 10-740 2021.

Biden campaigned in 2020 on canceling a minimum of 10000 in student. It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators. 17 hours agoIn general discharged loans and other canceled debt are considered taxable.

The Student Loan Debt Relief Tax Credit is a program. Maryland Adjusted Gross Income. 2021 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit.

Who wish to claim the Student Loan Debt Relief Tax Credit. About the Company Student Loan Tax Relief. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans.

The Deadline for the Student Loan Debt Relief Tax Credit is September 15. It was founded in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. There are a few qualifications that must be met in order to be eligible for the 2021 tax credit.

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. About the Company Student Loan Debt Relief Tax Credit Application Maryland Resident. Complete the Student Loan Debt Relief Tax Credit application.

About 1 in 5 Americans owe money on student loans for a total of 16 trillion debt or an average of 37013 per borrower. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

When setting up your online account do not enter a temporary email address such as a workplace or college email. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

Learn How The Student Loan Interest Deduction Works

Itt Tech Lawsuit In 2022 Student Loan Debt Forgiveness Federal Student Loans Student Loans

Are You Eligible For Sallie Mae Student Loans In 2022 Sallie Mae Student Loans Teacher Loan Forgiveness Student Loan Forgiveness

Student Loan Forgiveness Statistics 2022 Pslf Data

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

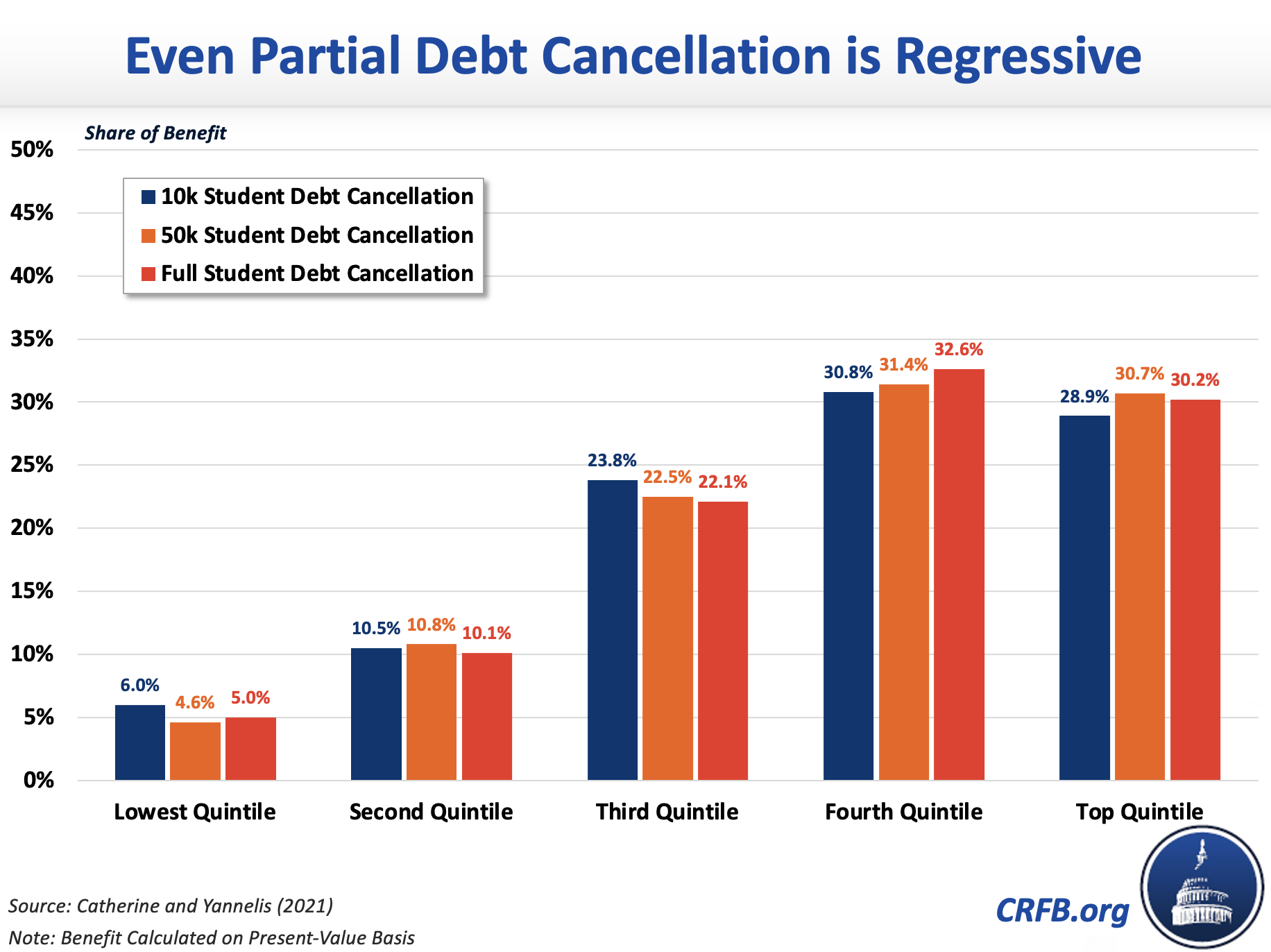

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

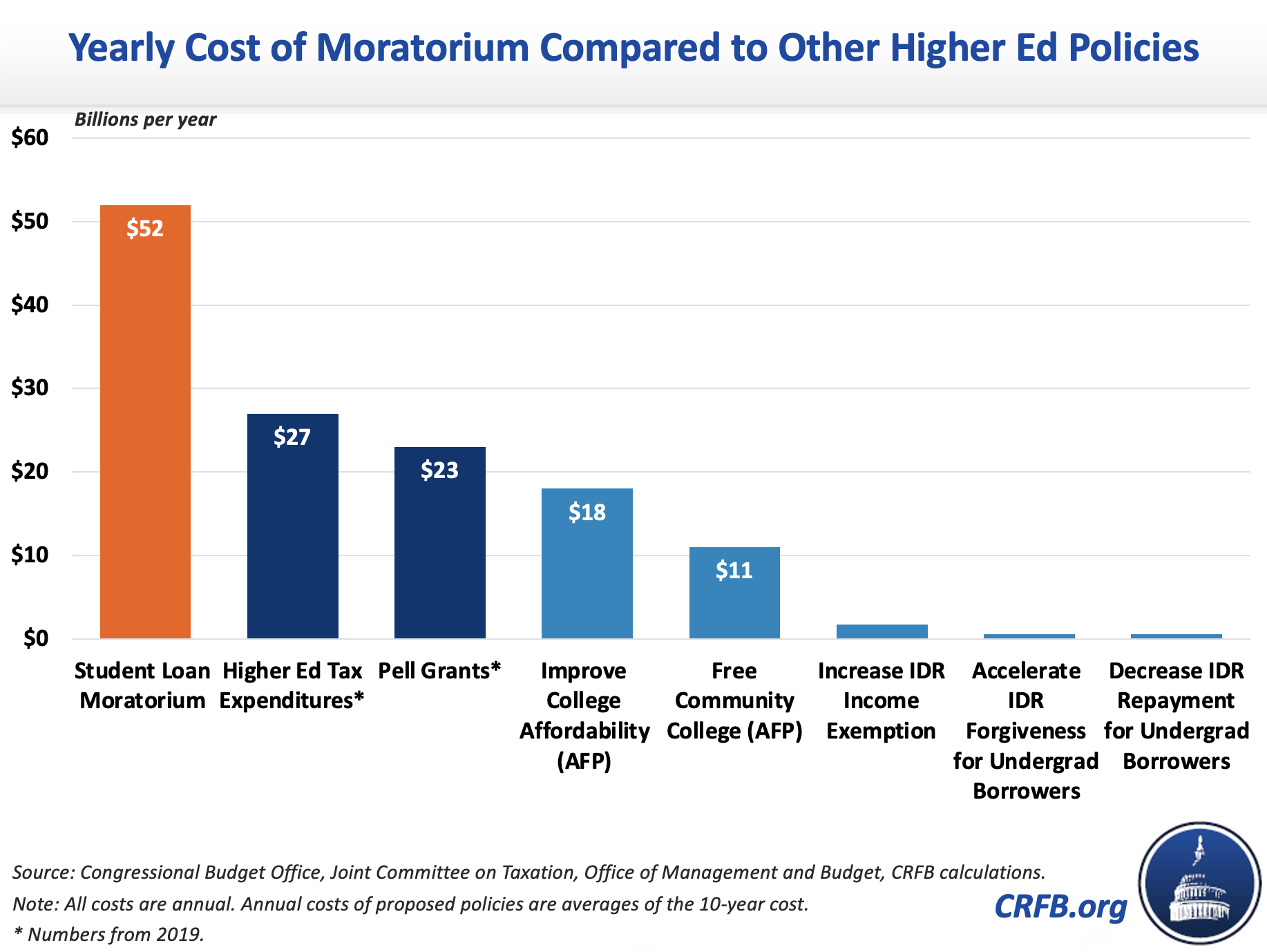

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Paying Student Loan Debt Modification Repayment Options

Student Loan Forgiveness Plans Enrage Boomers Unfair

Who Owes The Most Student Loan Debt

New Proposal Would Extend Student Loan Payment Pause And Cancel Student Loans

Who Pays For Student Loan Forgiveness Forbes Advisor

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

How To Qualify For 17 Billion Of Student Loan Forgiveness

Private Student Loan Forgiveness Alternatives Credible

Irs Tax Debt Relief 9 Ways To Settle Your Tax Debts Tax Relief Center Tax Debt Relief Debt Relief Irs Taxes

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Biden Won T Extend Student Loan Relief And Confirms Student Loan Payments Restart February 1